1) What is LL 97?

New York City’s Local Law 97 (LL 97) requires buildings over 25,000 SF to meet carbon emission caps by 2024 or be faced with steep fines. Carbon emission cap allowances will be lowered again in 2030. Fines can exceed $1,000,000 per year for the poorest performing buildings. LL 97 will push approximately 30,000 buildings in NYC to make upgrades.

2) What buildings are covered?

Covered buildings include: buildings that exceed 25,000 gross square feet (GSF); two or more buildings on the same tax lots that together exceed 50,000 GSF; two or more buildings held in the condominium form of ownership that are governed by the same board of managers and that together exceed 50,000 GSF are required to meet emission limits.

Local Law 97 excludes certain buildings, these include but are not limited to buildings with income restricted dwellings and rent regulated dwellings. Buildings with one or more income restricted dwellings such as those covered by Mitchell-Lama Law are excluded from Local Law 97 till 2034. Buildings with one or more rent regulated/stabilized units require certain prescriptive conservation measures for 2024 but will likely be required to meet 2030 emission limits. For more information, please contact us

3) When do I need to comply?

Covered buildings to comply with building emission limits on and after January 1st, 2024. By May 1st, 2025, and by May 1st of every year thereafter, the owner of covered building must file a report with the department.

4) How will I demonstrate compliance?

Compliance will be demonstrated through a report, submitted May 1st each year by the building owner’s consultant (a registered design professional). Building emissions levels will be calculated using benchmarked data for the building. Benchmarking is required for all buildings over 25 000 SF as per Local Law 84 and Local Law 133.

5) What are the penalties for non-compliance?

Owners of covered building will face civil penalty for not meeting building emission thresholds. This penalty will be not more than $268 multiplied by the ton of CO2 over the building emission limit. Failure to file a report will result in civil penalty in the amount not more than the gross floor area multiplied by $0.50 for each month the violation is not corrected.

6) How Do I Start the Compliance Process?

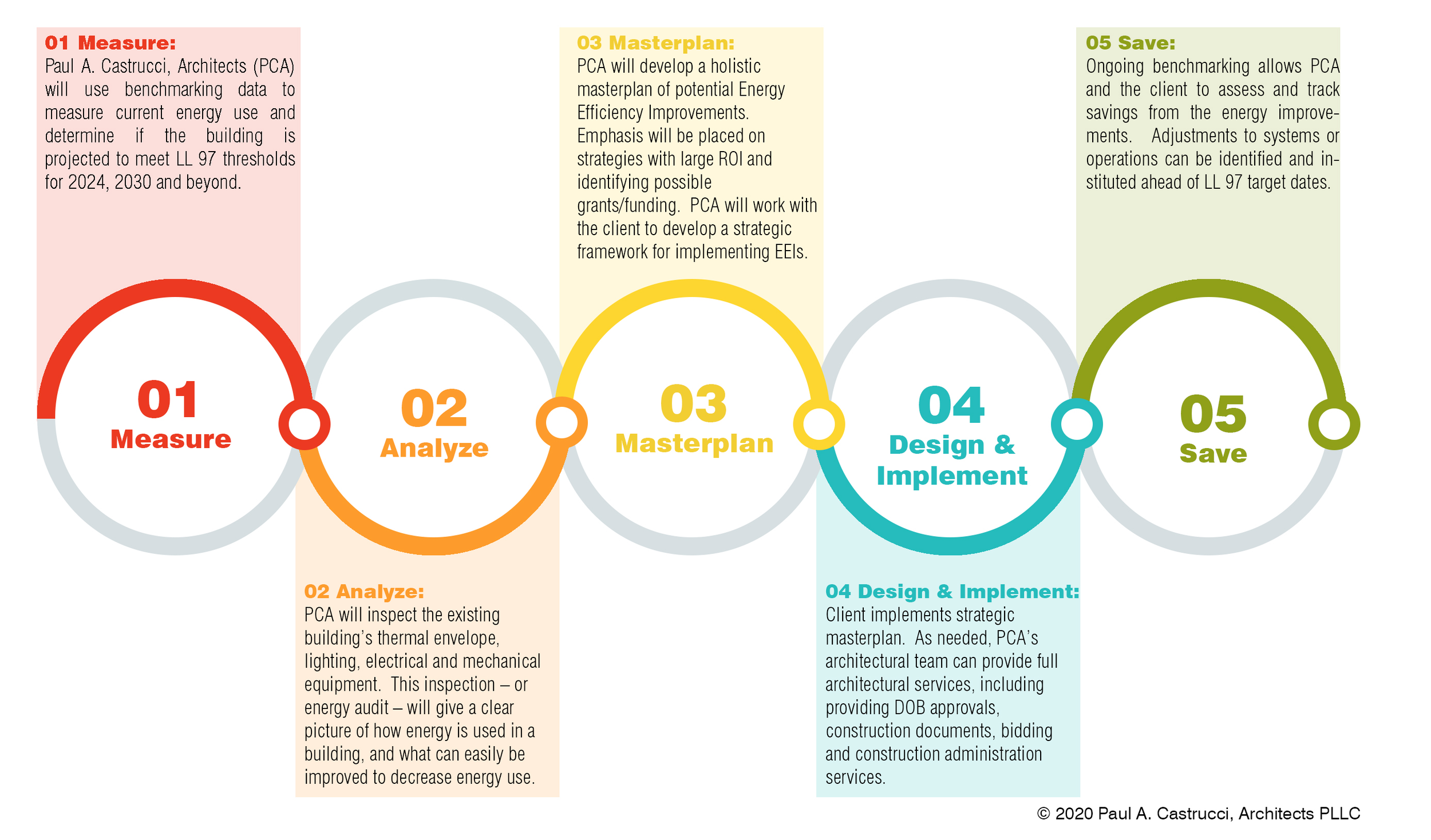

We recommend that building owners and property managers take a pro-active approach to LL 97 compliance. Buildings being brought into compliance at the deadline will face cost escalations due to competition for design services and labor, and will miss out on several years’ worth of energy reduction savings. We recommend a 5-step process for compliance (see below).

7) Why Work with PCA for LL 97 Compliance?

As both architects and energy modelers/consultants, Paul A. Castrucci, Architects (PCA) offers unique expertise to assist decision-makers identify and implement LL 97 compliance strategies. By combining our 30+ years of architectural experience and energy efficiency and modeling expertise, we can deliver inventive, streamlined solutions tailored to a specific building’s energy profile and economic needs. PCA’s architectural team can provide in-depth insight into constructability, cost, and logistics of proposed solutions.

To discuss how LL 97 impacts your property, please reach out to Paul or Grayson at [email protected] or 212-254-7060